1. Introduction

Australia’s disability support sector has grown rapidly — and the National Disability Insurance Scheme (NDIS) is a big reason why. For founders and investors, the big question is whether you should start from scratch or buy an existing provider.

- Starting usually costs less, but takes longer to build trust and referrals.

- Buying is faster, but you inherit systems, staff dynamics, and compliance history.

- Either way, your long-term value is driven by documentation, quality, and audit readiness.

2. What Is an NDIS Business?

The NDIS is a government-funded program that supports Australians living with permanent and significant disabilities. An “NDIS business” delivers approved services and is paid via NDIS funding (either through plan-managed, self-managed, or NDIA-managed arrangements depending on the service and provider).

Common Types of NDIS Businesses

- Support coordination

- In-home support / disability support workers

- Allied health (OT, speech, psychology)

- Supported Independent Living (SIL)

- Short-term accommodation (STA / respite)

- Group homes

- Specialist Disability Accommodation (SDA)

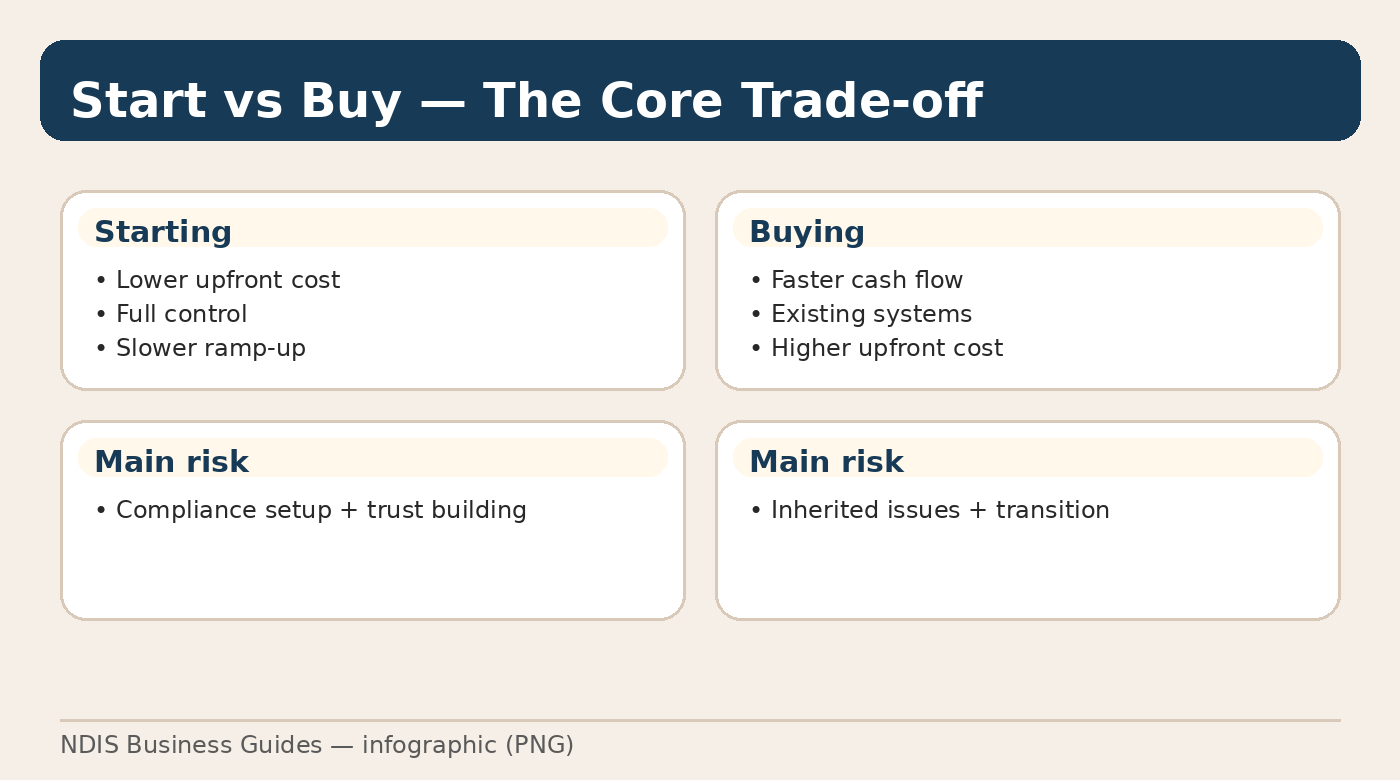

3. Key Differences: Starting vs Buying

Starting

- Build policies, systems, referrals, and team from zero

- More control over culture

- Slower ramp to profitability

Buying

- Acquire clients, revenue, and operating history

- Faster entry and often easier to finance

- Must manage inherited risks

Rule of thumb: Starting trades time for money. Buying trades money for speed and (often) more certainty.

4. Pros & Cons of Starting

Pros

- Lower upfront cost compared to acquisitions.

- Clean compliance slate and modern systems from day one.

- Culture control — hire and train to your standard.

Cons

- Time to revenue — often 6–18 months to stable referrals.

- Upfront compliance workload before meaningful income.

- Harder early trust with plan managers and coordinators.

5. Pros & Cons of Buying

Pros

- Immediate cash flow from existing participants.

- Operating systems and staff already in place.

- Historical financials support more predictable planning.

Cons

- Higher capital requirement (plus due diligence costs).

- Inherited risk — audits, complaints, reputation, processes.

- Transition risk — staff and client retention through handover.

6. Cost Comparison

Typical start-up costs

- Registration and audit: $8,000 – $20,000

- Policies, consulting, documentation: $5,000 – $15,000

- Insurance: $5,000 – $10,000

- Recruitment and training: $10,000+

- Marketing and referrals: $5,000 – $20,000

Estimated total: 💰 $30,000 – $80,000+

Typical acquisition costs

- Purchase price often: 2.5x – 4x EBITDA

- Legal + due diligence: $20,000 – $50,000

- Working capital buffer: 3–6 months

Estimated total: 💰 $300,000 – $3,000,000+

7. Decision Checklist

- Do I have sector experience (or a strong operator to hire)?

- How much capital can I commit without stressing cashflow?

- Can I tolerate a ramp-up period with lower revenue?

- Am I comfortable with audits, incident reporting, and governance?

- Do I want a small lifestyle provider or a scalable platform?

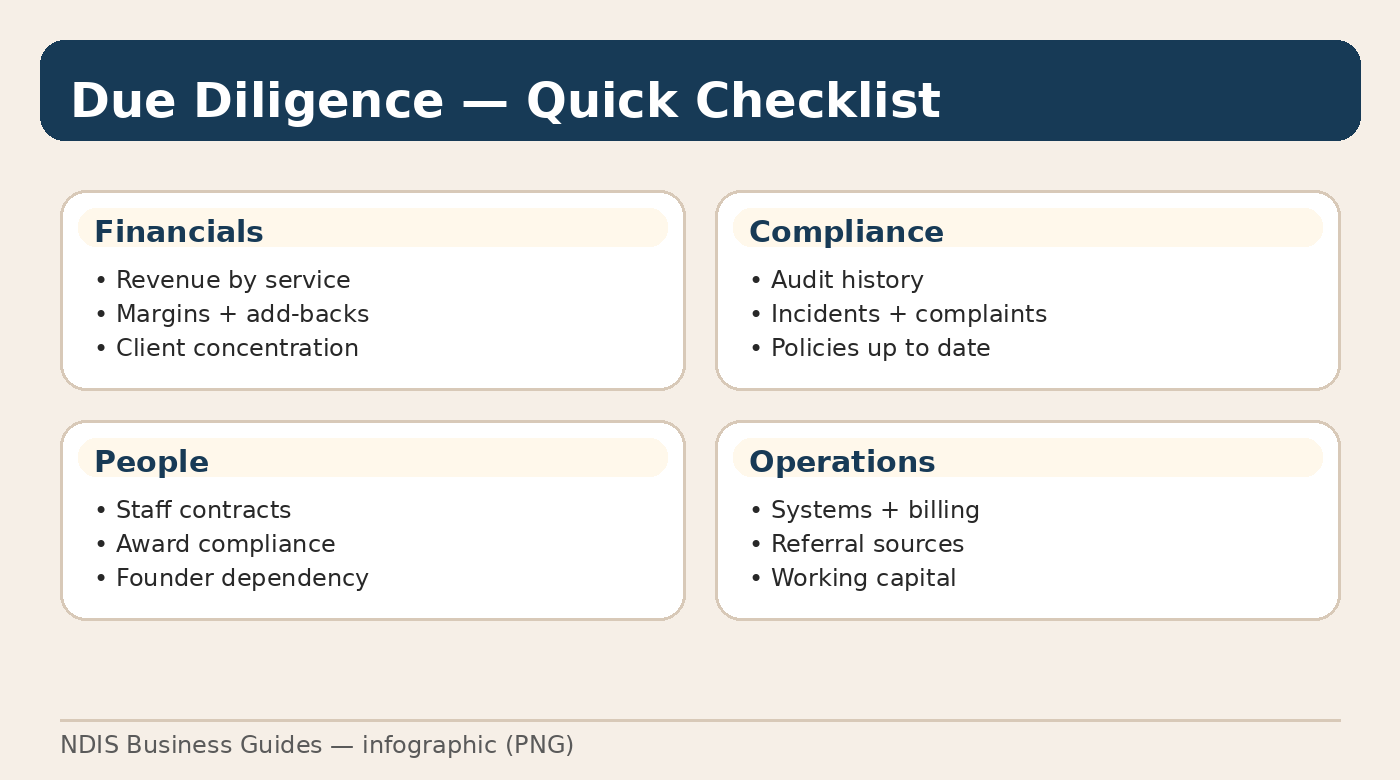

8. How to Evaluate a Purchase

Do not buy based on revenue alone. Validate what drives it, how stable it is, and whether it survives a change of ownership.

What to review

- Financials: margins, billing accuracy, service mix, contractor ratios.

- Clients: concentration risk, tenure, referral sources, churn history.

- Compliance: audits, incidents, complaints, quality management system.

- People: awards compliance, key-person risk, turnover, rosters.

Common red flags

- 🚩 Founder is essential for daily delivery

- 🚩 Poor documentation or missing policies

- 🚩 High staff turnover or weak recruitment pipeline

- 🚩 Inconsistent billing or unexplained revenue spikes

- 🚩 Large dependence on 1–2 participants

9. Legal & Compliance Checklist

- NDIS Practice Standards alignment

- Worker screening and role-based checks

- Incident management and reportable incidents processes

- Insurance: public liability, professional indemnity, workers comp

- Documented policies + evidence of staff training

In practice, compliance failures can destroy value fast — even for high-revenue providers.

10. Conclusion

There’s no universal “better” option — only what fits your budget, timeline, and risk tolerance. Many owners start small, then buy competitors once referrals and governance are stable.